st louis county sales tax rate 2019

Statewide salesuse tax rates for the period beginning April 2019. Louis Missouri 5454 percent and Denver.

Chicago Il Cost Of Living Is Chicago Affordable Data

Missouri has a 4225 sales tax and st.

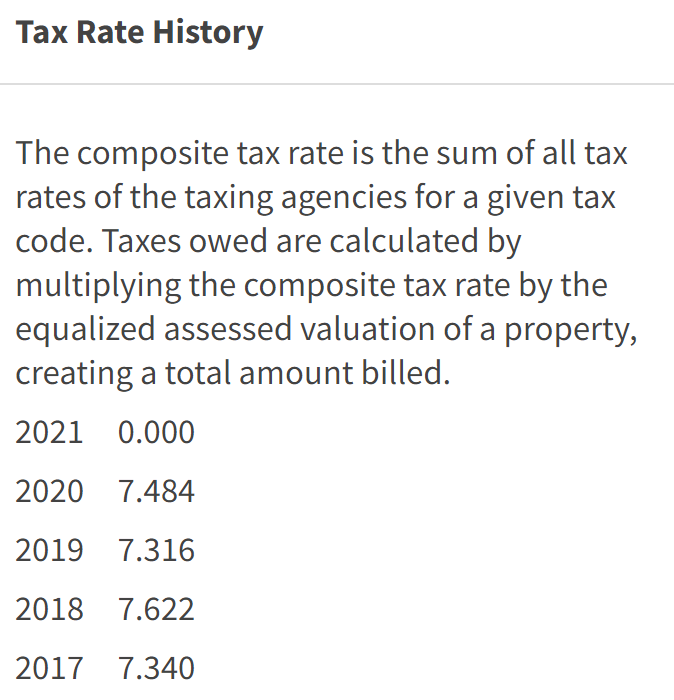

. There is no applicable county. The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax. In 2019 the tax rate was set at 816 and distributed as follows.

What is the sales tax rate in st louis county. The Saint Louis sales tax rate is. 2019 sales tax revenue.

ALL FUNDS REVENUES IN MILLIONS 2017 Actual 2018 Budget Estimate 2018 Revised Estimate. This is the total of state and county sales tax rates. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

Sales Tax Rates In Major Cities Tax Data Tax Foundation Chesterfield Missouri S Sales Tax Rate Is 8 738 St Louis County Has The Highest Tax Rates In The State St Louis Real. Louis County cities handle a 1 sales tax. 2020 rates included for.

A county-wide sales tax rate of 2263 is. Sales tax revenues are projected to increase by 63 million or 16 in 2019. In 2019 the tax rate was.

The minimum combined 2022 sales tax rate for St Louis County Missouri is. The Missouri state sales tax rate is currently. Lv meaning in texting.

Rate tables and calculator are available free from Avalara. In 2019 the tax rate was set at 816 and distributed as. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St.

2019 City of St Louis Property Tax Rate 69344 KB 2019 City of St Louis Merchants and Manufacturers Tax Rate 63897 KB 2019 Special Business District Tax Rates for City of St. 44 rows The St Louis County Sales Tax is 2263. You can print a.

Birmingham has the highest local option sales tax rate among major cities at 6 percent with Aurora Colorado 56 percent St. The County sales tax rate is. Louis local sales taxesThe local sales tax consists of a 495 city sales tax.

The Missouri sales tax rate is currently. The December 2020 total local sales tax rate was also 9679. 2 Statewide salesuse tax rates for the period beginning January 2019.

At issue was an arrangement detailing how St. This is the total of state county and city sales tax rates. Did South Dakota v.

012019 - 032019 - PDF. The County sales tax rate is. Statewide salesuse tax rates for the period beginning January 2019.

What is the sales tax rate in Saint Louis Missouri. The current total local sales tax rate in Saint Louis County MO is 7738. There is no applicable county tax or special tax.

Ad Download tables for tax rate by state or look up sales tax rates by individual address. The minimum combined 2022 sales tax rate for Saint Louis Missouri is.

Used Honda Civic For Sale In St Louis Mo

Lake St Louis Missouri Mo 63367 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Used 2019 Nissan Armada For Sale Near Me Cars Com

Cook County Property Tax Portal

Beer Taxes In Your State 2019 State Beer Tax Rankings

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Establishes Affordable Housing Trust Fund

Choosing Between Missouri And Illinois What Is Life Really Like Across The River

Collector Of Revenue St Louis County Website

Back To School Sales Tax Holiday Stlmotherhood

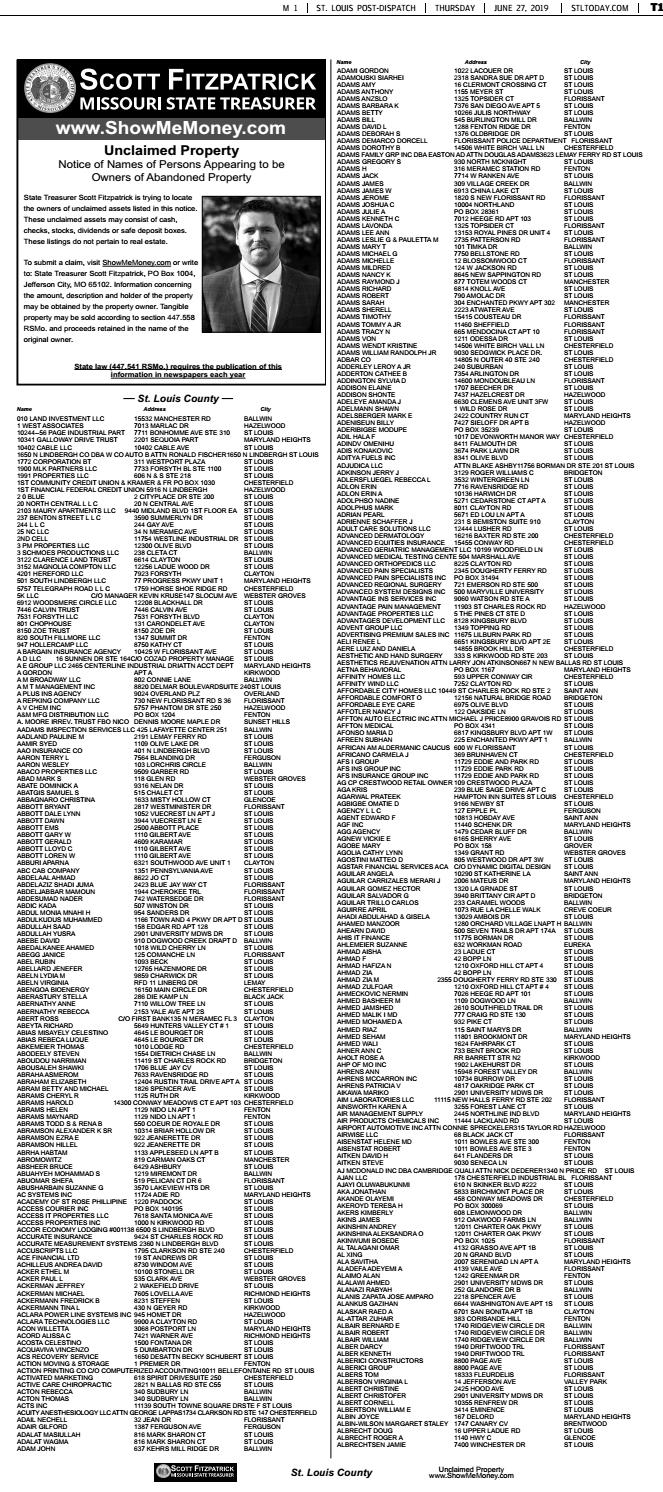

St Louis County 2019 By Stltoday Com Issuu

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Better Together St Louis City And County May Merge Bloomberg

Boeing Eyes Expansion At North St Louis County Campus Local Business Stltoday Com

Amazon Com St Louis County Missouri Zip Codes 36 X 48 Paper Wall Map Office Products